New Zealand’s Cosmetics & Personal Care sector outperforms Australia in Q3 2023

In the third quarter of 2023, the Cosmetics & Personal Care sector in New Zealand outperformed Australia, according to the latest manufacturing data presented in the Unleashed Manufacturing Health Index.

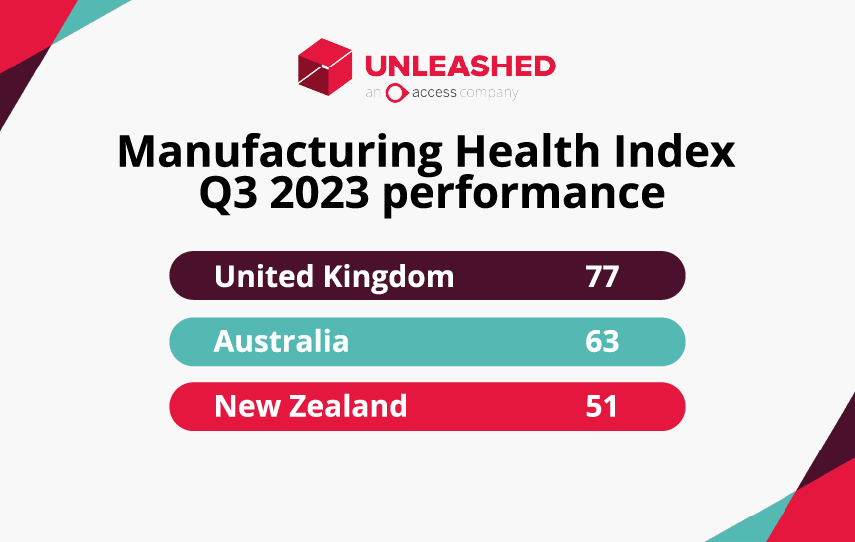

The index provides insights into the recovery status of small to medium manufacturing sectors in different countries, particularly the UK, Australia, and New Zealand. While the UK has shown favourable results, Australia’s performance is mixed, and New Zealand is currently at a turning point with some sectors facing stagnation.

The Unleashed Manufacturing Health Index, a quarterly business health and performance index, measures the fitness of the manufacturing industry on a scale of 0-100 for SME manufacturers in the UK, Australia, and New Zealand. The index calculates scores based on core performance metrics such as sales performance, purchasing, and internal efficiency, and benchmarks them against the previous nine quarters

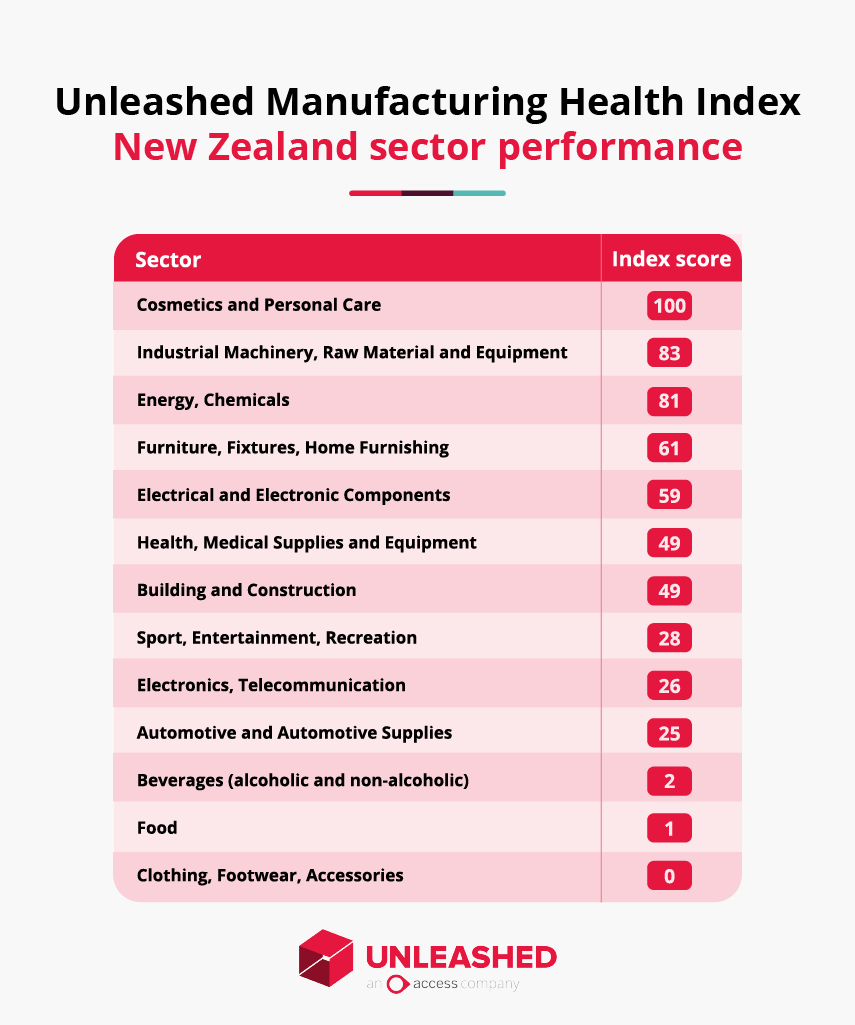

- Scores below 50 represent below average performance for each sector.

- Scores above 50 indicate above average performance

- Scores of zero or 100 represent historic minimum or maximum performance respectively.

The Q3 2023 index scores are based on more than 400,000 data points from 2,600 manufacturing firms using the Unleashed inventory management system.

According to the index, UK manufacturers have responded well to current global challenges, while Australian manufacturers lag the northern hemisphere, despite overall improvement. New Zealand manufacturing, meanwhile, is at an historic inflection point, with stagnant performance in multiple sectors.

The UK received a score of 77, followed by Australia with 63, then 51 for New Zealand. According to the data, it was New Zealand’s food and beverage, clothing, and construction industries that hindered its overall score.

Overall, the UK manufacturing industry has returned a glowing health report for Q3, outpacing its Australian and New Zealand contemporaries. These signs of growth have been spread relatively evenly across manufacturers, with 11 of the 16 industries studied measured above 50 health points.

The UK Cosmetics & Personal Care industry has delivered on 2022 predictions of high business performance with an overall health score of 98, the first-equal highest score.

Cosmetics & Personal Care (£86,602) have seen a steady increase in overstock levels in the last two years. But, as overall business health remains positive, and the level is far below average, this is less of a concern.

The Australian manufacturing industry is seeing a shrinking middle, with the majority of the 16 industries studied either doing poorly, or doing very well.

Despite some negative industry sentiment, manufacturers in the building and construction industry saw a positive health score of 76 in Q3, the fourth highest of the 16 industries analysed.

In contrast to New Zealand’s struggling beverage industry and general ‘craft beer recession’ rhetoric, Australian beverage makers are performing above their historic averages, with a 57 point health score. However, quarter-on-quarter profitability for the sector is trending down. Automotive and industrial machinery manufacturers are the best performers in Australia both taking 100 point health scores.

Australian Cosmetics & Personal Care manufacturers have run into difficulties, scoring an industry worst. Conversely, this was the best performing industry segment in New Zealand, on the back of two consecutive quarters of strong performance.

New Zealand made Cosmetics & Personal Care items are well into the green this quarter, scoring a perfect health score at 100. Emma Lewisham, RAAIE, Tronque, and Syrene Skincare, are among the most noteworthy homegrown brands of the past few years.

In general, New Zealand manufacturers have managed to maintain an average performance in Q3, scoring 51 out of 100 on the Manufacturing Health Index. At an inflection point in New Zealand with the entrance of a new government, the industry has the potential to head in either direction.

New Zealand’s food and beverage manufacturers are doing it particularly tough at the moment, scoring 1 and 2 out of 100, respectively – indicating historically low performance since 2021. The news will come as no surprise to New Zealand’s industry, which has been hit hard by shutdowns and restructures.

With regards to stock levels, New Zealand manufacturers have gradually started to shake the hangover of the pandemic with their stock control, holding an average of $155,334 in overstock, down from $166,372 in 2022 and $167,401 in 2021. Meanwhile, Australian manufacturers have continued to be dangerously overstocked, failing to de-risk following the post-Covid lessening of supply chain pressure. Current average overstock levels are at $259,390 of excess stock per business, up from $244,205 in 2022.

Read the full Unleashed Manufacturing Health Index findings here.

Main image: @__raaie__