Is ‘clean beauty’ on the decline? New data reveals more specific consumer preferences

Over the past few years, clean beauty has been among the fastest growing beauty categories across skincare, haircare, and cosmetics. However, a recent report by New York-based consumer trends agency Spate, has revealed a decline in growth year on year (-9.8%). According to the data gathered, consumers are seeking out more than just a cleaner product formulation – they’re now placing equal emphasis on ethics, environmental impact, and overall well-being, too.

Below are the key findings from Spate’s Clean Beauty Trends Report.

Clean beauty is a concept that is equally fascinating and frustrating to beauty industry insiders. On the one hand, a “clean” lens reveals a more educated — and critical — consumer. On the other hand, clean beauty has no single, regulated definition and often encourages the proliferation of false and occasionally dangerous information. In this report, Spate shares the top trending clean beauty-related terms consumers seek alongside the skincare, hair, bath & body, makeup, and fragrance categories. With 5.3 million searches on average each month for clean beauty trends across the beauty category, this is a trend that can’t be ignored

Keeping up with the shifts in clean beauty for brands and consumers can be exhausting and costly. Its meaning also fluctuates alongside consumer desires. With a -9.8% decrease in interest in clean beauty-related searches compared to the previous year, brands are confronted with the challenge of adjusting to this evolving landscape. Brands must engage in meaningful conversations, educate their customers, and demonstrate a commitment to evolving alongside their values in order to better navigate the ever-changing clean beauty terrain.

Clean beauty: skincare

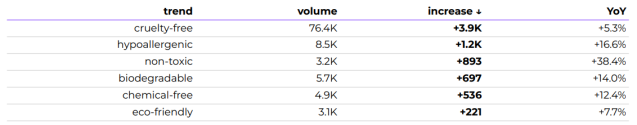

Clean beauty trends driving the biggest positive change in search volume across the skincare category:

Source: Google Search data, average monthly search volume, average monthly search volume increase, and year-over-year growth comparing the past 12 months ending April 2023 vs the 12 months prior (US).

Cruelty-free

- 76.4k monthly average searches

- +5.3% YoY growth

Top search queries

- Is cerave cruelty free?

- Is neutrogena cruelty free?

- Is cetaphil cruelty free?

- Is the ordinary cruelty free

- La roche posay cruelty free

- Is olay cruelty free?

- Is first aid beauty cruelty free?

Spate’s commentary

Cruelty-free refers to brands and products that aren’t tested on animals. However, to secure the Leaping Bunny certification — previously the gold standard, if not still currently — brands must also ensure their suppliers and manufacturers don’t test on animals. The fact that most top search queries for this term within skincare are branded reveals consumer skepticism around big brands like CeraVe, Neutrogena, and La Roche-Posay. Brands that don’t currently highlight cruelty-free have the opportunity to make this more prominent on packaging and marketing for consumers to feel more comfortable engaging with a brand that reflects their values.

Hypoallergenic

- 8.5K monthly average searches

- +16.6% YoY growth

Top search queries

- hypoallergenic sunscreen

- perricone md hypoallergenic firming eye cream

- hypoallergenic lotion

- hypoallergenic face moisturizer

- hypoallergenic face wash

- hypoallergenic eye cream

Spate’s commentary

Across skincare, consumers are particularly concerned with hypoallergenic sunscreen. This reflects not only what consumers want but also their past experiences. The focus on hypoallergenic sunscreen reveals how consumers have had reactions they may want to avoid. Eye cream appears twice in the top queries, indicating another category consumers are apprehensive about causing allergies. Brands with certifications regarding allergenicity should consider ways to support the increasingly wary consumer. Featured ingredients certified to be hypoallergenic can also be called out in marketing

Non-toxic skincare

- 3.2K monthly average searches

- +38.4% YoY growth

Top search queries

- Non-toxic sunscreen

- Best non-toxic sunscreen

- Non-toxic self-tanner

- Non-toxic face sunscreen

- Non-toxic baby sunscreen

- Non-toxic chemical-free sunscreen

- Non-toxic tinted moisturizer with spf

Spate’s commentary

Non-toxic is another essential clean beauty skincare query that reveals how consumers are looking to sunscreen. Owning most of the top questions, toxicity is a growing concern for consumers in their searches for SPF. It’s worth noting this is also likely the result of fear mongering and false information that’s spread online. Brands that feature filters considered “toxic” on the internet should tackle these false claims head-on. Emphasise the safety of products and ingredients where possible using published studies and clinical trials.

Clean beauty: hair

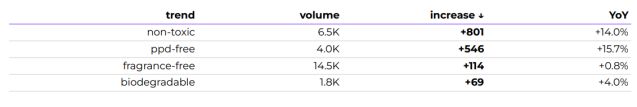

Clean beauty trends driving the biggest positive change in search volume across the hair category:

Source: Google Search data, average monthly search volume, average monthly search volume increase, and year-over-year growth comparing the past 12 months ending April 2023 vs the 12 months prior (US).

PPD-free

- 4.0K monthly average searches

- +15.7% YoY growth

Top search queries

- PPD free hair dye

- PPD free hair dye loreal

- PPD free hair dye in stores

- PPD free hair dye shampoo

- PPD free hair dye wella

- PPD and PTD free hair dye

- PPD free hair dye Clairol

Spate’s commentary

Consumers today have become increasingly aware of the potential risks associated with hair dye ingredients like p-Phenylenediamine (PPD). PPD is a commonly used chemical that helps achieve long-lasting and vibrant hair color but can cause adverse skin reactions in some individuals. With a growing emphasis on safety and personal well-being, consumers are actively seeking hair dye alternatives free from PPD. Hair dye brands should further dig into this concern, researching its root cause and if it’s something to consider in existing and future formulations

Clean beauty: bath & body

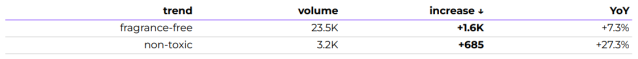

Clean beauty trends driving the biggest positive change in search volume across the bath and body category:

Fragrance-free

- 23.5k monthly average searches

- 7.3% YoY growth

Top search queries

- fragrance free body wash

- fragrance free lotion

- fragrance free deodorant

- fragrance free hand soap

- purell hand sanitizing wipes fragrance free

- dove fragrance free soap

- neutrogena body oil fragrance free

Spate’s commentary

For every action, there’s an equal and opposite reaction as they say. In this case, a growing interest in fragrance products during the pandemic was met with increasing interest in fragrance free products in various categories. The growth of fragrance-free searches starting in bath and body reflects a growing group of consumers that prefers to keep fragrances out of their body care products. Searches point especially to body wash, baby wipes, and fragrance-free lotion. Brands with fragrance free options can seize on this moment and attract a new audience using this growing interest.

Download the full report free here